Các bài báo kỹ thuật

Đã xuất bản 01/2019

Optimising Capital Equipment Return on Investment

Considerations for Tenders and Asset Lifecycle Management

Whilst equipment tenders are the ubiquitous technique for achieving optimised up-front costs for capital equipment purchase, the truly excellent tender ROI performance is reserved for tender process design that also captures operating expenditures of assets for evaluation. This TOTEX, or total expenditure, is a metric which shows the genuine performance of assets over time and optimisation of this factor is the hallmark of the sagacious asset manager.

If only capital equipment upfront cost comparisons were a measure of long term investment, procurement teams would be greatly automated. In practice, professional judgment on total life cost of assets is far more important than a simple purchase price comparison, guaranteeing the purchasing team a promising future.

However, for the electrical equipment industry, this means evaluation of some technical practicalities in lifetime operation of the equipment, which in some product designs can aggregate to become an extensive cost burden to the unfortunate utility shackled by selection of poor quality equipment.

Evaluating TOTEX is essential, as it is a sum of CAPEX and OPEX. A tender process which evaluates only a component of TOTEX will derive hidden costs for buyers, as commercial forces shift the weighting of costs between these constituents. A cheap upfront purchase will inevitably run up operational expenditure over its lifetime, as the cheaper construction choices result in higher maintenance and field failure performance risks. Effective tendering will capture the full process, providing prudent procurement practices and maximising performance of the assets for capital invested.

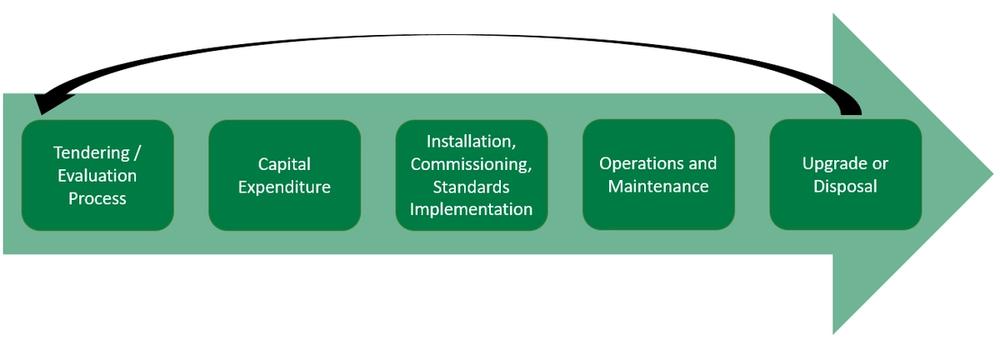

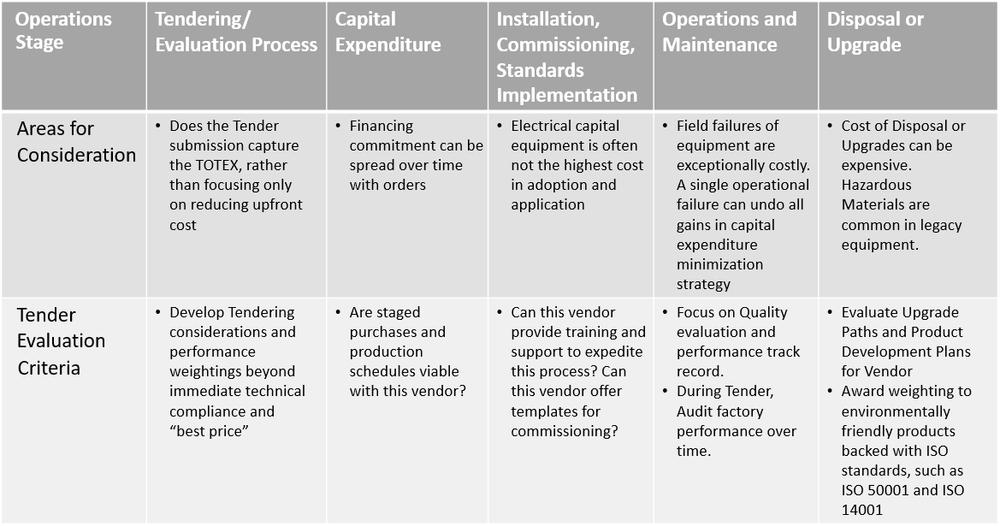

Outlined in figure one, the total expenditure process highlights the full-service life of capital equipment. In the context of electrical equipment, evaluation of considerations such as failure risk, environmental performance and product end of life upgrade/disposal options can provide tremendous shifts in the total expenditure for holding an asset.

For products such as Auto-Reclosing Circuit Breakers, these devices are deployed in networks for improving network reliability. The rich irony in minimising upfront capital expenditure is that products built to minimise upfront costs often introduce more network reliability issues, rather than solve them. Economic myopia is a genuine risk when evaluating products such as these on capital expenditure face value.

Below is an extrapolation of the TOTEX process for capital equipment, framed with informative investigation areas for effective interrogation of vendor performance during a tender process. By considering these areas, we evaluate the total expenditure and risk profile of the electrical capital equipment purchase, resulting in maximising the true ROI rather than short-term face-value performance.

“Bottom line is, the cheapest tendered price for capital equipment is not always the most economical choice once you consider the total operating life of the asset,” reports NOJA Power Group Managing Director Neil O’Sullivan. “A good example of this is buying equipment with SF6 gas insulation will have significant life time costs and/or disposal costs that quite often cannot be justified when the total operating cost of the life of the asset is considered. Ultimately, you get what you pay for.”

NOJA Power has been serving the electrical industry for almost two decades with their network reliability products such as the OSM Recloser system. Experience after years of tenders and witnessing field performance not only leads to improved product design, but as an organisation engaged in its own procurement practices NOJA Power has developed internal guidelines to secure the best performance from its own internal assets.

Quan tâm đến Công nghệ mới nhất về phân phối điện năng?

Hãy tham gia vào danh sách nhận các bài viết kỹ thuật hàng tuần, chúng tôi sẽ chia sẻ kinh nghiệm trong nghành kỹ thuật điện toàn cầu trực tiếp đến hộp thư của bạn

Đăng ký →